In the world of modern business, automation is becoming an increasingly important element to help increase efficiency and reduce costs. Insurance is no exception. Automation of insurance processes allows companies to speed up claims processing, improve customer service and minimize the risk of errors. In this article, we take a look at what insurance automation is, what opportunities it offers, and what platforms exist on the market for it.

Insurance Documentation Management

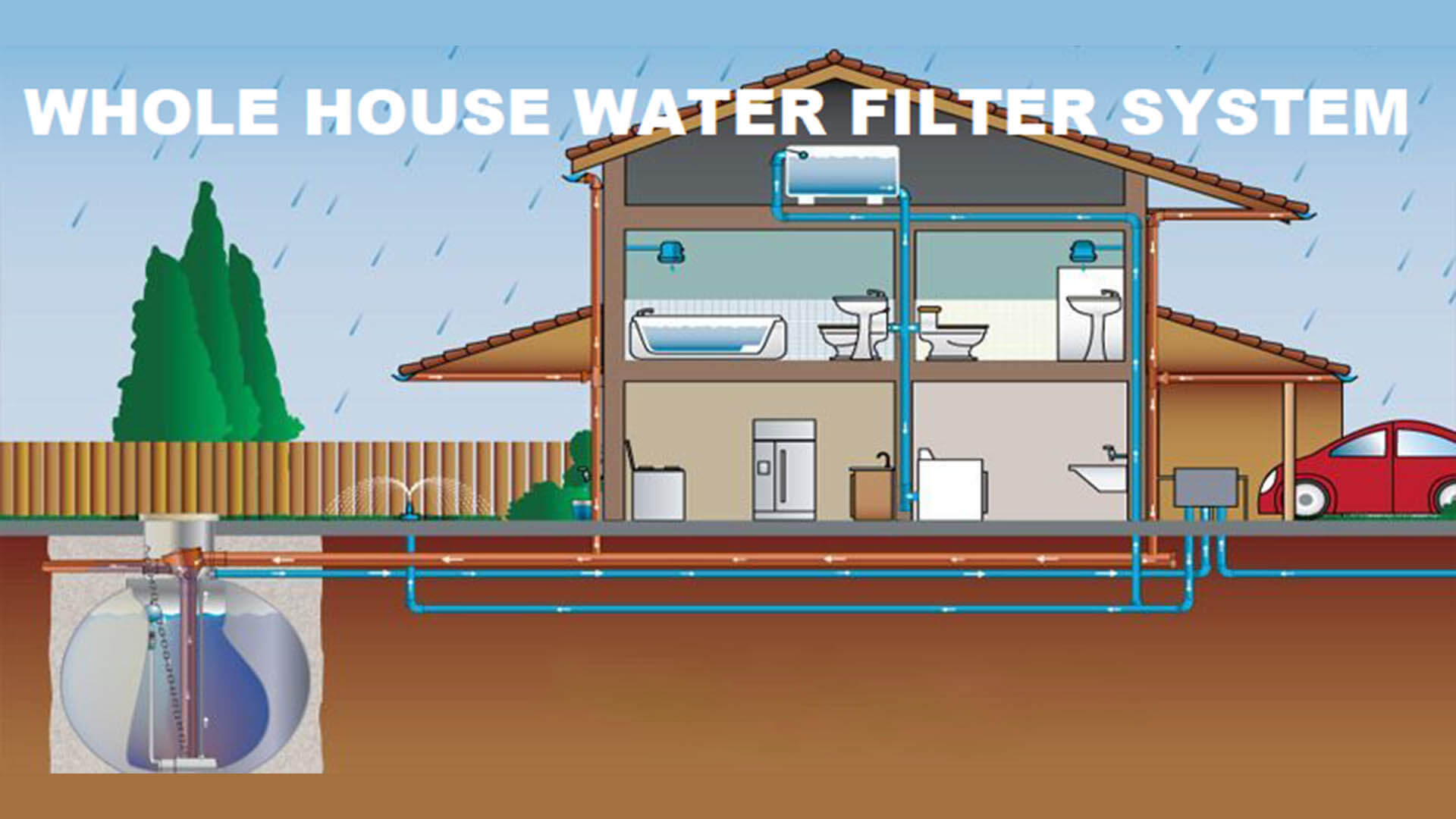

One of the key aspects of the insurance business is document management. This includes the processing of applications, policies, contracts, payouts and other documents. Traditional methods of document management in the insurance business face a number of challenges. First, they are labor intensive, as processing large volumes of documents manually is time-consuming and requires significant staff resources. Secondly, the human factor plays a significant role: data entry errors, incorrect form filling and other inaccuracies can lead to delays and reduced quality of work. Third, manual processing of documents is often slow and does not allow for quick adaptation to changing conditions. Finally, searching for the right documents in paper archives takes a lot of time and effort, reducing overall efficiency.

Document management automation offers many benefits. Software allows you to process large amounts of data in seconds, which significantly speeds up all processes and increases their efficiency. Automation reduces the risk of human error through the use of algorithms and compliance checks. It also results in resource savings as the need for significant staff resources for routine tasks is reduced, allowing employees to focus on more important aspects of work. Electronic archives provide ease of storage and access to documents, allowing you to quickly find and access the information you need at any time. Modern systems also provide a high level of data protection, preventing unauthorized access and loss of information.

Insurance Automation

Insurance automation covers a wide range of processes, including the following:

- Processing claims is one of the most time-consuming steps in the insurance process. Automation can speed up the collection and verification of information needed to make decisions on applications. Systems can automatically verify data sent by customers, compare it with internal and external data sources, and assess whether applications are eligible.

- Policy issuance. Automation can significantly reduce the time it takes to issue insurance policies. Systems automatically generate documents, check them for compliance with standards and send them to customers for signature. It is especially useful for insurance companies working with a large number of clients, as it reduces time costs and improves accuracy.

- Claims management. Automating the claims management process helps insurance companies process claims quickly and efficiently. Systems can automatically accept claims, check them against policies and other terms and conditions, and calculate payout amounts. It not only speeds up the process, but also reduces the risk of errors and fraud.

- Data analysis and risk assessment. Modern insurance companies have vast amounts of data that must be analyzed to make informed decisions. Automation enables the use of machine learning and artificial intelligence techniques to analyze data and assess risk. It helps companies more accurately determine insurance premiums and minimize losses.

- Customer interaction. Automation improves customer interactions through the use of chatbots, automated support systems and personalized offers. Customers can quickly get answers to their questions, submit applications and receive updates on their policies through channels that are convenient for them.

Modern technologies such as artificial intelligence, machine learning and blockchain are playing an important role in the development of insurance automation. They enable the creation of intelligent systems that can make decisions on their own based on analyzing large amounts of data. For example, artificial intelligence can be used to analyze customer history and predict customer needs, while blockchain provides security and transparency of operations.

Insurance Automation Software Overview

There are many insurance automation software on the market. Let's review some of them.

PandaDoc

PandaDoc for insurance offers a complete solution for creating, sending and tracking documents. Its features include electronic signatures, workflow automation and integration with other systems, making it a popular choice for insurance companies.

Guidewire

Guidewire provides a platform for managing insurance operations, including claims processing, underwriting, and policy management. The system is geared toward large insurance companies and offers powerful analytical tools.

Insly

Insly is a cloud-based platform for managing insurance brokers and agencies. It automates policy creation, manages client data and keeps track of commissions.

Duck Creek Technologies

Duck Creek Technologies offers modular solutions to automate various aspects of the insurance business, including underwriting, claims and policy management. Their platforms easily integrate with other systems and provide flexibility in customization.

Sapiens

Sapiens provides insurance process management solutions including underwriting, claims and policy management platforms. Their systems utilize modern technologies such as artificial intelligence and machine learning to improve efficiency and accuracy.

Conclusions

Insurance automation is a powerful tool that helps insurance companies increase efficiency, improve customer service, and reduce operational costs. Modern platforms offer a variety of solutions that can be customized to meet the specific needs of each company. Implementing such systems allows insurance companies to remain competitive in the marketplace and better cope with growing data volumes and increasingly complex customer requirements.