Investing in a pre-construction condominium can be a strategic way to secure a valuable property at a favorable entry price. Many buyers appreciate the chance to purchase a residence before it is finished, given the potential for appreciation and modern amenities. Although there may be risks, a thoughtful plan can improve outcomes. This article covers the important factors to review when evaluating pre-construction opportunities.

Key Takeaways

1. Neighborhood and Infrastructure Are Crucial: Owncondo highlights that well-located areas and ongoing public projects often produce higher appreciation.

2. Developer Reputation Can Influence Returns: Verify the builder’s past achievements to limit structural or legal headaches later.

3. Payment Plans and Rental Potential Matter: Owncondo emphasizes matching installments to expected profits so that overall finances remain balanced.

Owncondo – Your Trusted Partner for Pre-Construction Condo Investments

Owncondo is a platform that helps customers simplify their search for pre-construction condominiums and homes in the GTA and across Canada. The team at Owncondo leverages extensive market knowledge to enhance property exploration, allowing buyers to concentrate on key features and potential benefits in both established and emerging neighborhoods.

By featuring the biggest selection of condo listings, Owncondo provides options that fit a wide range of budgets and lifestyles. The platform offers real-time price checks, enabling buyers to stay current with ongoing changes. In addition, its experienced real estate agents are praised for being friendly and efficient, guiding individuals throughout their purchase without unnecessary confusion. This commitment to clarity and variety allows Owncondo to stand out as a practical choice for anyone seeking value and reliable information.

Key Attributes of a High-Potential Pre-Construction Purchase According to Owncondo

Experts at Owncondo emphasize that verifying certain criteria can help minimize potential complications. The following points highlight key aspects frequently considered by prospective buyers:

1. Location Factors

- Proximity to business centers, schools, and transit lines.

- Future infrastructure plans in the surrounding areas.

- Crime statistics and local community engagement.

2. Developer Track Record

- Completed projects delivered on time.

- Quality of past construction.

- Industry awards or recognitions.

3. Project Design and Amenities

- Modern layouts that accommodate efficient space usage.

- Facilities such as pools, fitness centers, and recreational areas.

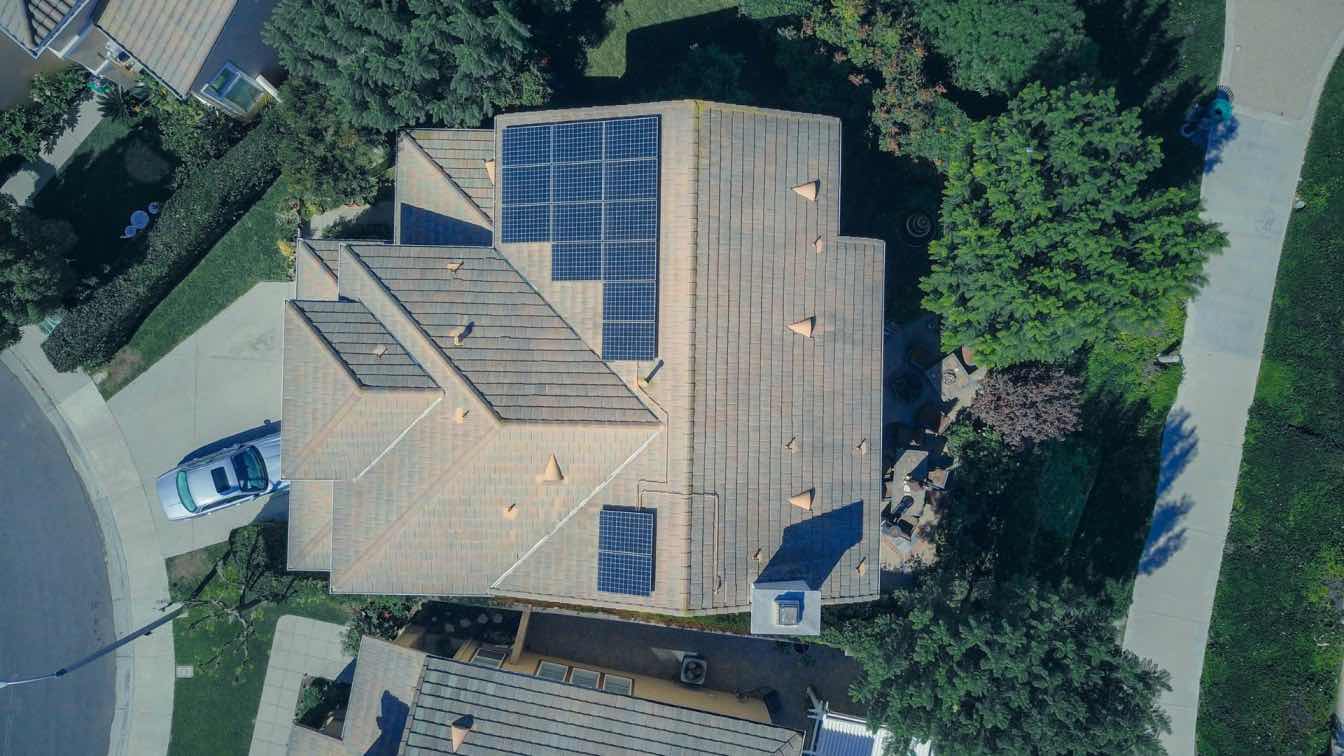

- Green features for energy conservation and long-term savings.

4. Financial Terms

- Clear deposit schedules.

- Favorable cancellation clauses.

- Potential for payment flexibility if market conditions shift.

The Owncondo research team highlights data from the Canadian Real Estate Association (CREA) that shows centrally located condo developments experienced approximately 5.2% annual price growth from 2015 to 2022. Buyers who research local trends and builder credentials can further refine their choices when selecting pre-construction condos that align with their long-term goals.

Owncondo Analysis: Neighborhood Evaluation and Infrastructure Overview

Source: https://www.thestar.com/news/gta/this-toronto-neighbourhood-was-named-one-of-canadas-best-places-to-live-in-new-report/article_a428519c-3f92-11ef-96be-cb7c456f2e35.html

According to the experts at Owncondo, pinpointing a promising neighborhood involves a detailed study of population growth, retail expansions, and transportation upgrades. Rapidly growing districts can register a 10% higher appreciation rate compared to more mature areas. Owncondo reveals that properties situated near ongoing transit projects often record a 12% value increase over a five-year period, emphasizing the significance of monitoring new infrastructure proposals and government-backed improvements. To review current listings in areas with notable growth potential, explore pre-construction homes for a variety of premier developments across the GTA and Canada.

Focus Areas for Neighborhood Assessment

1. Municipal investment in roads and transit.

2. Presence of reputable schools or universities.

3. Retail expansions, restaurants, and public recreational spaces.

A closer look at these indicators can highlight districts likely to see a rise in demand once the condominium reaches completion.

Why Developer Reputation is Crucial in Real Estate According to Experts at Owncondo

Owncondo suggests that verifying a developer’s background can provide a significant advantage. An established company tends to have better resources and a proven track record of delivering well-built units on time. Owncondo indicates that projects from reputable developers often achieve occupancy rates above 90% within the first year. Potential buyers may also obtain references from prior purchasers, review any public reviews, and consult with real estate attorneys who have handled closings for that specific builder.

Five Questions to Ask About Developer Reliability

1. Has the firm concluded any large-scale condo buildings over the last decade?

2. Were there any major scheduling delays?

3. Has the developer faced legal disputes from dissatisfied buyers?

4. Are there design awards or professional commendations?

5. Does the company promptly communicate changes and updates to buyers?

These points can be crucial in distinguishing a credible project from one that might struggle with delays or construction issues.

Exploring Owncondo Recommendations: Payment Schedules and Profit Potential

According to insights from Owncondo, an effective payment plan helps reduce financial stress. Many developers allow installment payments spread across the project timeline, and some even offer discount structures for early buyers. The experts at Owncondo emphasize that comparing potential rental income against anticipated mortgage costs is another significant aspect. In Canadian metro areas, the Canada Mortgage and Housing Corporation (CMHC) recorded a steady 6% average annual price growth for condominium units between 2015 and 2022, suggesting that buyers who enter the market early can benefit from expected appreciation.

Potential Ways to Optimize Profit

Early Purchase Incentives: Early registrants sometimes receive discounts on parking or storage units.

Rental Yield Estimates: Evaluate probable monthly rent and local vacancy rates.

Assignment Sales: Some buyers sell the purchase contract prior to project completion for potential gains.

Easy Ways to Lower Risk with Helpful Tips by Owncondo

Based on Owncondo analysis, a significant step in mitigating uncertainty lies in legal and financial due diligence. This may include verifying permits, understanding fees, and reviewing any clauses that allow the developer to alter unit layouts or occupancy dates. According to the research team at Owncondo, the following actions can reduce sudden surprises:

Secure Legal Advice: Hire an attorney who specializes in condominium transactions.

Review Final Plans: Double-check any changes in floor layouts or amenities.

Confirm Fee Inclusions: Request a breakdown of monthly fees, including parking, maintenance, and utilities.

Check Regional Rules: Some areas have regulations on condo presales, so it’s wise to be aware of local guidelines.

A consistent and methodical approach can streamline the process of identifying potential pitfalls well ahead of move-in day.

Highlights from the Canadian Condominium Market Based on Owncondo Research

Housing analysts from Owncondo present estimated data on condo appreciation in selected Canadian metropolitan areas from 2015 to 2022, along with common rental yield figures. The numbers below come from property boards and additional research sources:

|

City |

Average Annual Condo Price Increase |

Typical Gross Rental Yield |

Notable Factor |

|

Toronto |

7.5% |

5.2% |

Rapid transit extensions |

|

Vancouver |

5.9% |

4.7% |

Tourism & international interest |

|

Montreal |

5.3% |

4.5% |

Diversified employment market |

|

Calgary |

4.1% |

4.2% |

Energy sector fluctuations |

|

Ottawa |

4.8% |

4.4% |

Steady government employment |

These numbers provide a basic reference for potential investors researching growth patterns. Results can vary based on building quality, neighborhood demand, and other localized variables.

FAQs

Q: How long does a pre-construction project usually take to complete?

A: Timelines can vary, but many developments require two to four years before occupancy is possible. Most builders issue periodic progress updates to keep buyers apprised of any changes.

Q: Are pre-construction condos more affordable than resale units?

A: They can be, depending on the neighborhood and the timing of the purchase. According to insights from Owncondo, those who enter early may secure a more favorable price, which can appear quite advantageous once the property is finished.

Q: How can a buyer gauge a developer’s financial stability?

A: Owncondo indicates that reviewing a builder’s previously completed projects, public financial documents, and feedback from past purchasers is a beneficial approach. Speaking with individuals who already own units from the same developer can also offer helpful perspectives.

Q: What if someone needs to sell a unit before project completion?

A: According to the experts at Owncondo, many contracts allow assignment sales, meaning a buyer can transfer their contractual rights to another individual. Owncondo recommends verifying any associated fees or limitations in the original purchase agreement.

Conclusion

By examining all these factors — location potential, reliable developers, favorable financial structures, and thorough contract checks — you can target a pre-construction condo that has a considerable likelihood of success. Expert platforms such as Owncondo are ready to support you with the biggest selection of options, experienced agents, and accurate price information, making the entire process clearer and more efficient.